Entire Greece is hit by a humanitarian crisis effectuated by economic crisis and austerity. Who can’t pay his rent any longer will become a „modern homeless person“ , „neo Astegos“ seen in many places of Athens. Hit by a crisis, 5 years are a very long time! 5 years free fall and there’s no end in sight.

Text auf Deutsch: Humanitäre Krise in Griechenland aufgrund von wirtschaftlichen Interessen und Erdgas?!

Entire Greece is hit by a humanitarian crisis effectuated by economic crisis and austerity. Who can’t pay his rent any longer will become a „modern homeless person“ , „neo Astegos“ seen in many places of Athens. Hit by a crisis, 5 years are a very long time! 5 years free fall and there’s no end in sight.

Mostly hit for six are the unemployed, the old and the sick. Retirees can’t defend themselves against

cutbacks, juveniles don’t have any prospects, the sick are left without medicine and medical treatment.

Up to date, a quarter of Greek citizens live below the breadline, whereas further 37% are threatened by poverty.

25% of Greek population at employable age are unemployed, also 50% of juveniles up to 25 years are struck. Many families depend on the retirement pension of their grandparents.

Ready in 2010 an EZB study has proofed that mainly the bank salvation reduced the land to need.

Credit risk raised while the bank’s credit risk decreased to the same degree. Paradoxically the originator demanded additional risk charges from Greece.

After the American investment bank Lehman collapsed in September 2008, most nations – Greece amongst them – had given extensive guarantees for their banks. Some arguments indicate that first of all the governments of the major nations are partly to blame for the financial crisis. They believed in economists, who preached the efficiency of financial markets and had been strung along by a powerful and financially strong bank lobby.

Series of studies suggest that governments and banks of issue are partly to blame for the disaster subverting public budgets. As major economics like Germany with major banks and international leading central banks have pushed the deregulation one could deduce they assume special responsibility for nations like Greece, one of the major bereaved.

According to it’s heading ”Credit Booms Gone Bust“ the study indicated:

Most financial crises since 1970 were burst credit bubbles, which could had been avoided if governments and central banks only would have limited credit expansion in time.

The study also revealed: since banks raised their total assets and their balance sheet risks around 1970 the frequency of crises considerably raised. With this risky policy banks reacted to the central banks massive interventions they started in WW2 to deal with burst credit bubbles.

If the bank system became illiquid banks could rely on the legislating of needed liquidity by banks of issue and, in case of need, state support.

Depositors and tax payers will bear the risk

The more and more urgent need of money forces Greece to undertake radical methods. The government gives up it’s resistance against privatization is starting to sell the silverware but not islands and monuments, so told in 2011. Former Euro Group Director and since November 2014 president of the European Commission, Jean-Claude Juncker, made clear that this has to be the precondition for the next tranche of international support. In any case Greece has to raise privatization to get the projected 12 billion €.

Former minister of economy and precursor of Sigmar Gabriel wanted to support Greece to get more attractive for foreign investors.

In October 2011 Rösler visited Athens with a delegation of managers and presented some sort of „European Recovery Programme“ for more economic growth. Rösler has invited 70 entrepreneurs to participate in his journey to Greece.

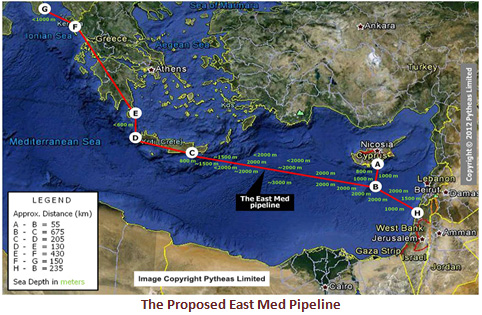

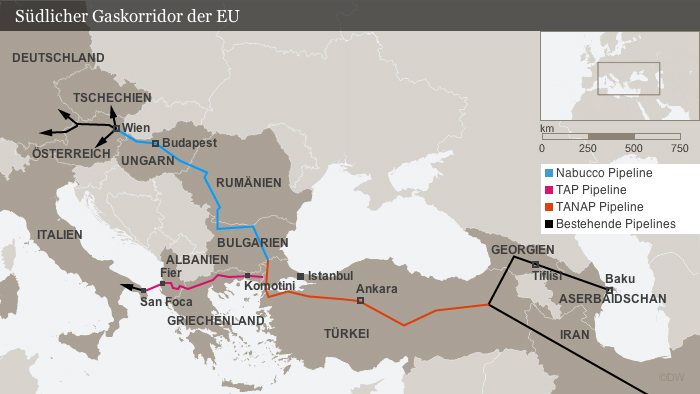

With him he took the plans for the Trans-Adriatic Pipeline, E.on Ruhrgas participated at that time. The amount needed is about 1.5 billion €. Gas shall be transported from Azerbaijan via Turkey and Greece to the south of Italy. About 800 kms long, 478 kms will transit Greece. In 2015 the phase of construction will start, 2,000 workplaces will be created and in 2018 gas transmission will begin, so said in the meeting with Rösler and his entrepreneurs 2011 in Greece.

Don’t we know all these promises about workplaces and wealth? Honestly, have these promises ever been kept?

Nowadays – 4 years later – we determine that there is a growth. Regrettably not as Rösler promised Greece, but in poverty.

And Greece is going to be exsangiunated furthermore.

Misimpression’s are spread by government’s company magazine „BILD“ to make sure this tragedy was Greece’s own fault by writing e.g.: „Each german citizen has paid 1,055.-€ for Greece’s crash!“

That a Spain bank was saved and then, 2 years later has been sold out BILD didn’t tell us.

Link: Das große Fressen: Blackstone und der Ausverkauf von Spanien

Former financial news informed us about upgrading a public business development bank modeled on German KfW, improving conditions for foreign investors and moreover Athens wanted to pay their outstanding accounts from German enterprises in three-digit nine-figures rapidly. Not really much left over for Greek people since Rösler’s and his entourage’s visit in 2011.

The lie about Greece’s adavantages of the Trans Adriatic Pipeline

According to a top-level functionary of J&P AVAX the construction of the Trans Adriatic Pipeline causes more drawbacks than advantages.

The great TAP deception has been uncovered: Greek enterprises stay beyond the project! This top-level functionary’s exposures given at a congress made explode a „megaton bomb“. His informations stripped down the scenario of Greece’s rise to an „energy player“ and annuls the advantages the nation will have by selling DESFA and by activating the agreement to build the Trans Adriatic Pipeline transporting Azerbaijan’s gas to Europe.

This major project, Greek prime minister yet travelled to Azerbaijan, will not have any additional benefit for Greece, but sill cause politic and diplomatic problems. It is to add that in this agreement the typical compensation benefits like e.g. an adjustment for local ecological damage are not even scheduled.

Practically TAP has no economic advantage

As unveiled at the congress by a functionary of the building company J&P AVAX, all the workplaces – so much advertising was made – the construction of the pipeline will create – have only served to disguise that all regulations selectively expulse Greek construction enterprises – including everything having to do with it.

Triple evil for Greece

The bottom line is a „Troika“ too. Practically zero profit for the country, revaluation of Turkey and compression lever in Cyprus.

– Greece is not entitled to consume only one of the approximately 16 million cubic meters leaving Azerbaijan. 6 million cubic meters will stay in Turkey, the rest runs to Europe.

– corresponding to the agreements Greece will not touch one single Euro from transit fees

– 90% of the famous workplaces refer to this part of construction over a concrete period until the pipeline will be finished in 2019 in Greece (it will be put in operation between 2013 – 2025) Guess which sort of employees the construction companies will employ?

Foreign workers of course.– 1.5 billion Euros Greece should „earn“ mainly refer to the ouster of real estate assets to follow for the pipeline’s construction on Greece’s territory.

– only Albania and Turkey will take strategical profits. Somehow or other Turkey would have taken profit unless with TAP or Nabucco

– an announcement to this subject by SYRIZA is concentrated on the practically inexistent economic advantage says into alia:

„In spite of all proclamations about investments and growth no substantive use for Greece seems to exist. Even representatives of the entrepreneurs are keenly criticizing the management of TAP and declare, regarding the construction sector quite nothing will stay in the country because advertisements are cooked by specifications tailor-made for certain companies. (sknews.gr)

We pursued this subject – to show you what is happening in and with Greece. And always keep in mind Rösler’s and his entourage of 70 entrepreneurs’ visit in Greece 2011 to claim privatization.

Europe and the gas imports from Russia

Memories are brought back when Russia shut off the supply of gas due to unpaid gas bills. Also Europe has been cut off from their major source of gas. In 2009 European Union which imports most gas in Ukraine pipelines tried to avoid energy scarcity.

EU, the European Bank for rebuilding and development (EBWE) and other international banks tied an aid package of $1.7 billion to support Ukraine’s gas supply and presented a reform to avoid such crises in future.. (PIPELINE POLITICS IN EURASIA – UKRAINE MUST REFORM TO TAP EU ENERGY AID und THE BLACK SEA: A HOTBED OF CORRUPTION OVER OIL AND GAS DEPOSITS?)

Meanwhile Ukraine crisis aroused and besides the conflicts between Russia and Ukraine one subject comes to the fore: energy.

EU is depending on Russian energy imports – primarily GAS. (Energiehunger in der Ukraine-Krise)

36% of European gas supply are running through pipelines from Russia. Germany imports more than a third, Hungary more than 80% and Slovakia is depending up to 92% on Russian gas imports.

As aforementioned TAP made part of Rösler’s luggage.

The Construction of Trans Adriatic Pipeline TAP – only 540 kms of the planned 880 km-pipeline will be omitted to Greece

Gas supply – TAP is to deliver 20 billion cubic meters from 2025 on!

Here some facts:

– Until end 2015 the constructions to connect the Cyclades with the continental power supply system are to be started to have the 240 million Euro project co-financed by EU and European investment banks. German energy technology company ABB is ranking among the companies having received assignments for sub-projects.

– Lots of projects to develop the distribution grids are planned. Also the connections to Albania, Bulgaria, Macedonia, Turkey and Italy are to improve and to equip.

– within the scope of the memorandum for restoration of Greek economy under supervision of the „Troika“ (IMF, EU commission, European Central Bank) Greece is bound to connect Crete with the central energy supply system.

– natural gas – the Greek privatization program provides to sell national gas company DEPA. The sale failed in 2013. There is no time frame for a new advertisement. Early in 2014 the prices for Greek gas imports from Russia were lowered about 15%. The national Azerbaijanian gas company SOCAR paid 400 million Euro for the majority share of 66% of Greek gas pipelines system DESFA.

– carbon (lignite) – lignite is one of the most important energetic raw materials of the country. All 19 lignite power plants with a capacity of 4.930 MW are still belonging to the former national energy company PPC. Corresponding to planned privatization this shall change. The greatest countrywide infrastructure project is PPC’s newest lignite power plant (Ptolemaida 5) with a capacity of 660 MW. Construction will be undertaken by a consortium under guidance of Greek construction company Terna.

link: Reformen auf dem griechischen Energiemarkt sorgen für Aufruhr

Privatization exacted by the „Troika“ (European Commission, European Central Bank and IMF) are equal to a vast „Monopoly“ game with predetermined winners and losers.

In crisis hit nations privatization exacted by the Troika result in billion-dollar-losings German newspaper „Tagesspiegel“ noted.

Corresponding to the German newspaper’s investigations national properties were sold under enormous time pressure and far below value.

One example is the privatizations of Athen’s Airport area „Elliniko“. Greek origin Spyros Pollalis, professor for urban development at the University of Harvard, established a study which estimates the value of the former airport about at least 1.236 billion €.

In the end tax authorities will receive from their investing in Lamda Development (banker Spyros Latsis ist holding 51%) only the half of their input viz. 577 million €.

Shah Deniz Consortium’s 880-kms pipeline will transit Greece, Albania and Italy to Europe. Estimated project costs: about 1.5 billion €.

Shah Denis ist on of the biggest natural gas fields worldwide stockpiling about 1 trillion cubic meters.

Discoevered in 1999 and situated 70 kms south-easterly of Baku in the deep-sea zone of the Caspian Sea in a depth of 50-500 meters. The treaty areal is about 859,8 squkm. Running this field enables Azerbaijan to cover interior demand and beyond that to export the surplus.

High-ranking representatives of policy, economy and science met at CDU’s Day of Economy 2015, 9th of July. About 2800 participants kept themselves busy with diverse current politico-economic subjects. We already reported on this meeting because Jeb Bush gave an address, too.

See: Obama geht Bush kommt

Also SOCAR Germany’s director took part in the big event besides other representatives of many energy companies. SOCAR, cutting-edge for the southern gas corridor, shall deliver increasing quantities of gas to Europe and therefore has a share in European security of gas supply.

Mediterranean Gas Storage

Three more international gas projects are planned for Greece, so said in GTAI’s article of 5/9/2015 called „Mediterranean Gas Storage“, „Trans Mediterranean Gas Pipeline“ and „EuroAsia Interconntor“. These three exploration projects at greek west coast proceed. The contractors for searching hydrocarbon reserves were chosen in 2013.

2007 The “Great Game” Enters the Mediterranean: Gas, Oil, War, and Geo-Politics

„Trans Mediterranean Gas Pipeline“

March 2014 Greece to commission feasibility study for Mediterranean gas pipeline

EuroAsia Interconnector

EuroAsia Interconnector is a joint venture of DEH-Quantum Energy (Cyprus) and Israel Electric Corp.

The project is going to start near Haifa and will cost about 4 billion Euros until completed in 2022.

The EuroAsia Interconnector will be the longest submarine power supply line worldwide. With a length of 1,150 kms in a depth of 2,000 m it will deliver 2,000 MW. According to an agreement between Israel, Cyprus and Greece, signed on 3/4/2012 the power supply line will be constructed in Haifa. It will take course from Israel to Cyprus (300 km) to Crete (600 km) to the onshore of Greece (250 km) where it can be connected to the european mains supply.

References:

The East Mediterranean Geopolitical Puzzle and the Risks to Regional Energy Security (2013)

ENERGY: Cyprus-Israel to boost submarine cable (June 2015)

http://www.euroasia-interconnector.com/

http://www.snipview.com/q/EuroAsia_Interconnector

http://www.antibaro.gr/article/11700 Nov.2014

Lastly in May 2015 the european commission approved 15 financial support agreements for preferential energy infrastructural projects all over Europe. It took place in the framework of the facility „Connecting Europe Promotional Programme“. Among these 15 financial support agreements are 4 gas infrastructural projects and all of them are determined for south eastern european markets: two in Greece, one in Croatia and a cross border connecting line.

Having examined the significant projects – according to the European Commission and out of consideration for the upstream sector – investments to the amount of 70 billion € are required until 2020. Subject to the ultimate approval of European Fund for strategic investments (in 2015) – european capital add up to 4.7 billion € for gas and power PCIs between 2014 – 2020.

„Upstream“ means the process of search and exploitation of raw materials before the production process. Upstream sector is mostly involved with search and exploitation in the offshore regions and in many cases in the deep sea.

CAUTION!

The prospect of a regional production in the Black Sea and the Adriatic Sea is very attractive to both: the national governments and the EU.

Currently we experience that in Spain: 10.000 protesting against oil production previous to Lanzarote and Fuerteventura. Since July 2014 about 300,000 were protesting on 8 Canarian islands against test drilling by REPSOL, which was approved down to a depth of 3,000 – 6,900 m.

The company declared to start the test drillings this year. A referendum was planned on november 23rd by head of government Paulino Rivero.

Central government in Madrid took the referendum for inadmissible and wanted to submit the case to constitutional court.End of September 2014 test drilling of the italian-corean consortium ENI/KOGAS started in gas field 9 previous to cyprus’ shores. US company NOBLE ENERGY Int. and Israeli enterprises Delek Drilling and Avner Oil are already drilling in gas field 12 since June 2013.

Connecting Europe and strategic partners

from the web site http://www.handwerk-international.de

Connect Europe is closely connected to Enterprise Europe Network, the biggest european network of European Commission.

Members are economic organizations from more over 40 nations representing important strategic partners for Connect Europe.

So they’re close to local companies but with a global view given from the network. Enterprise Europe NetworkMore strategic partners are exhibition corporations, still the most important platform for small and medium sized enterprises.

Exhibition corporations are internationally linked and outstandingly informed about the newest global developments.

During the support period 2007-2013 EU provides measures to support european integration with round about 864 million €.

A great deal of these measures will be dedicated to projects advancing the merging in Europe by supporting cross-border cooperation and producing additional capacities for innovative european act.

Connecting Europe Facility (CEF)

– is a main EU instrument for growth, employment and competitiveness by selective infrastructural investments on the European scale.

It is divided in 3 sectors:Important and interesting is this publication of EU Commission

The schedule lists 132 projects in the field of power transmission, transmission, storage and liquified natural gas (LNG)

Electricity interconnection – European Commission – Europa

Questions and Answers: projects of common interest in energy

Plans of common October Projects of common pdf. interest – energy 2014 interest in the field of power transmission

Important and interesting HORIZON 2020

- HORIZON 2020 unifies 3 strategic priorities:

– scientific excellence incentives in Europe, i.a. by increased promotion by European Research Council (ERC)

– safeguarding industrial leading position in innovation and competitiveness incentives and promoting of key technologies

and innovations in KMU

– solution contributions of social competition as there are health, alimentation and food security, clean and efficient

energy, intelligent and clean traffic circulation etc.Still existing public-public and public-private partnerships could be supported in the framework of HORIZON 2020,

provided that fixed criteria will be achieved and having reached clear progress, according to the 7th Scientific Framework Programme, including:

- – European and developing nations clinical trial partnership(EDCTP)

– Ambience assisted live (AAL)

– Baltic research and development programme (BONUS)

– Eurostars

– European Metrology Research Programme (EMRP)

– European Energy Research Alliance (EERA)

– Innoviative Medicine Initiative (IMI)

– Clean Sky

– Standard European Sky Airtraffic Research (SESAR)

– Fuel Cell and hydrogen (FCH)

– Embedded Computer Systems (ARTEMIS)

– Nano Electronics (ENIAC)

– future factories

– energy efficient buildings

– european initiative for environmentally responsible vehicles

– future internetlinks

Offizielle HORIZON 2020 Homepage

HORIZON 2020 Homepage des BMBF

Factsheet: FP7 Cooperation themes in Horizon 2020

Factsheet: Regeln in HORIZON 2020

HORIZON 2020 Best Practice Beispiele

Horizont 2020 – das Rahmenprogramm für Forschung und Innovation, Mitteilung der Kommission

Project partners

For EU conveyance means could deploy in applicable extent HORIZON should develop more tight synergies with national and regional research and innovation programs, e.g. in the form of public-public partnerships.

More applicable extent should be achieved by consolidating HORIZON 2020 means in framework of a public-private partnership in key sectors, which account in research and innovation in further tenor for Europe’s competition goals and to master social challenges. To tackle efficiently many intermediate goals determined by HORIZON 2020 it is necessary to cooperate with third countries.

In the fore of the international cooperation in the frame of HORIZON 2020 are partnerships with industrial and emerging nations and countries falling in the categories of extension, neighborhood policy and development.sourceMore Information: Welcome to the Innovation & Networks Executive Agency

„Trans Adriatic Pipeline makes headway“

From an article of DW 10/04/2014:

By circumventing Russia TAP shall deliver gas from the Caspian Sea transiting northern Greece and Albania to Italy where it will be connected with the european supply system. Funding of the southern European gas corridor seemed to be built on sand since German energy giant Eon and french TOTAL company signalized in February 2014 they wanted to bail out TAP project – what they did end of September 2014.

In the meantime another investor is ready: Spain’s biggest gas supplier Enagàs is assuming most of Eon’s shares. Most important shareholders are British energy giant BP, Norwegian Statoil plus Azerbaijanian national company SOCAR with 20% each.

Actually only 16,6 billion € (ergo 8.8%) of the total amount of 212 billion €, the Troika accorded Greece until July 2013 to cover primary deficits as salaries and pensions etc. and 4,9 billion € more (2.3% of GDP) to meet liabilities – means only 11% of the total amount arrived in real economy.

In other words up to and including 2014 a total of 89.4% of the available financial means (official credits and own sourcing) were expended to fulfil their obligations toward creditors.

The upswing promised by the Troika has been hold off on 2014 and later – until today the upswing is a long time coming. Where should it come from, if even export world champion Germany isn’t able to pay it’s debts.The „Black Zero“ is only promising – not making more debts – but what about the reserves for pensions, are they already included?

Greece’s most important creditors (2011)

- Rank Institution/Bank Bonds and other value papers (in billion €) Credits (in billion €)

1 European Central Bank (EZB) 49,0 –

2 EU credits – 38,0

3 Greek public purses 30,0 –

4 Foreign Nation Funds 25,0 –

5 International Monetary Fund (IMF) – 15,0

6 National Bank of Greece 13,2 5,4

7 National banks of EU zone 13,1 –

8 Piraeus Bank (Greece) 8,0 –

9 EFG Bank (Greece) 9,0 –

10 FMS (Bad Bank of HypoRealEstate) 6,3 –

11 National Bank of Greece 6,0

12 BNP Paribas (France) 5,0 –

13 ATE Bank (Greece) 4,6 –

14 Alpha Bank (Greece) 3,7 –

15 Dexia (Belgium , Luxemburg, France) 3,5 –

16 Hellenic Postbank 3,1 –

17 Generali (Italy) 3,0 –

18 Commerzbank (Germany) 2,9 –

19 Société Générale (France) 2,9 –

20 Marfin (Greece) 2,3 –

21 Groupama (France) 2,0 –

22 CNP (France) 2,0 –

23 AXA (France) 1,9 –

24 Bank of Cyprus (Greece) 1,8 –

25 Deutsche Bank & Deutsche Postbank (Germany) 1,6 –

26 LBBW (Germany) 1,4 –

27 ING (Netherlands) 1,4 –

28 Allianz (Germany) 1,3 –

29 BPCE (France) 1,2 –

30 Ageas (Belgium) 1,2 –

31 RBS (Great Britain) 1,1 –

32 DZ Bank (Germany) 1,0 –

33 Unicredito (Italy) 0,9 –

34 Intesa San Paolo (Italy) 0,8 –

35 HSBC (Great Britain) 0,8 –

36 Erste Bank (Austria) 0,7 –

37 Munich Re (Germany) 0,7 –

38 Rabobank (Netherlands) 0,6 –

39 Crédit Agricole (France) 0,6 –

40 KBC (Belgium) 0,6 –

Source: Barclays Capita

Energy projects as the construction of a crude oil terminal at Cyprus shall stimulate investments from 2016 on. More international projects as „mediterranean Gas Storage“, „Trans-Mediterranean Gas Pipeline“ and „EuroAsia Interconnector“ are in planning stage – but how will the Greeks benefit if all of this is only available for foreign investors. According to logical reasoning – if a country is driven into insolvency lots and national real estate are sold on good terms. Certainly you remember forced sale?

Example: Cyprus – Privatisation

The new law about privatization of national and semi-national enterprises was adopted in March 2014 . The national Port Company and national telephone company will be privatised in 2016.

Selected major projects

Project title Capital expenditure (million Euro) Project status Note

Crude oil products terminal for transit trade at Vassiliko 300 completion and inauguration in 2014 Investor: Vital Tank Terminals International with consortium Ioannou Paraskevaidi1Motorway Pafos-Polis 170 negotiation ended without having found contractor; a procedure was instituted to reduce expenses; forming of a statutory framework projected Promotor: ministry of energy, trade, industry and tourism

Conzession contract: DBFO Project

Nikosia Beltway and feeder circuit 310 Is to be announced in 2015 Promotor: ministry of energy, trade, industry and tourism

Co-funding by EU

Port and Marina of Larnaca (construction of the port building, port upgrading, construction of a metal runway; construction of other buildings, f.e. hotels) 200 Consortium Zenon is looking for funding Promotor: ministry of energy, trade, industry and tourism

Motorway Limasol-Saitta 22,5 km 150 planning to finish in 2015 Promotor: ministry of energy, trade, industry and tourismconnecting road Limasol Port – motorway Limasol-Pafos 95 Construction phase 1a and 1b finished; phase 2a already started; announcement for phase 2b/2c Promotor: ministry of energy, trade, industry and tourism

Co-funding by EU

Motorway Nikosia-Palaioxori 19 km 150 Planning to be finished in 2015 Promotor: ministry of energy, trade, industry and tourismGas connecting line EuroAsia Interconnector: Israel, Cyprus, Greece Being planned, to be finished until 2019, agreed by EU, EU decree no. 1391/2013 Gas connecting line EuroAsia Interconnector: Israel, Cyprus, Greece

Trunk line from Cyprus offshore to Crete to greek onshore agreed by EU, EU decree no. 1391/2013 Promotor: ministry of energy, trade, industry and tourism

Source: Cypriot Ministry for Traffic and Projects – Department for public projects – found on Gtai

While some privileged still enrich at the expense of the citizens and an insolvent state, broad levels of population despair. Due to the hard belt-tightening measures salaries declined since 2009 on average up to 40%, the association of trade unions estimated. Approximately 1.4 million people are unemployed but according to official data only 145,000 of them touched their unemployment benefit in 2013. In Greece this backing is only given for one year. Therefore anybody is reliant on the support of family, church and communities. Youth unemployment is about 60%!!!!

German physicians demand to stop austerity from the Federal Government. Greek Government shall have the opportunity to face the humanitarian catastrophy in their country.

The association of democratic physicians (VDÄA) sent out a delegation to Athens. The 25 members of VDÄA and IPPNW (International physicians to prevent atomic war, Physicians in social responability) have been scandalized about the extent of humanitarian crisis: Austerity and following unemployment excluded every third person from health assurance. Striking staff shortage in health care. Due to austerity no specialized personal could have been employed. During the visit to Athens General Hospital „G.Gennimatas“ the absurd results have been highly visible: patients with diverse psychiatric diagnosis had to sleep in the corridors while the new floor above the crowded ward is empty. Furniture can’t be paid and the personnel to take care of the patients can’t be employed Dr. Diallina, head of department explained.

More than 3 million people in Greece without health insurance can’t afford any longer vital remedies, e.g. Insulin or cancer treatment. In succession nursling death rate is increasing, more cases of HIV, Tuberculosis, first cases of Malaria and a boost of heavy depression. Due to rising unemployment and poverty more and more people get unsheltered. The physicians can only value the Troika’s fading out of the heavy crisis in health- and social systems as inhuman.

„Health, education and social policy has to have priority, not debt service. So we demand to stop austerity from the federal government which is instrumental in promoting!“ Dr. Wulf Dietrich, chairman of vdäa said.

„The right to health is a human right hold good for all humans“ said physician and president of the European IPPNW, Dr. Angelika Claußen.

More information http://www.mkiellinikou.org/en/

Greece and the new Greek government requiring a further haircut (on debt) went not down well in Bruxelles and Berlin. We all should realize even export world champion Germany isn’t able to extinguish it’s debts. So please – how Greece or any other country can be able to manage this?

The majority of Greeks don’t want to see their head of government, Alexis Tsirpas, to buckle in Bruxelles.

Even so if an agreement is no longer possible. Plenty’s got nothing left to loose but their pride!

© Netzfrau Doro Schreier

translated by Netzfrau Patricia Kölb-Schur

Original: Humanitäre Krise in Griechenland aufgrund von wirtschaftlichen Interessen und Erdgas?!